According to the Office of Financial Operations, the cost of educating a Dickinson student in the fiscal year 2011-2012 amounted to $66,480. Each student was charged $53,860 in tuition, room and board fees.

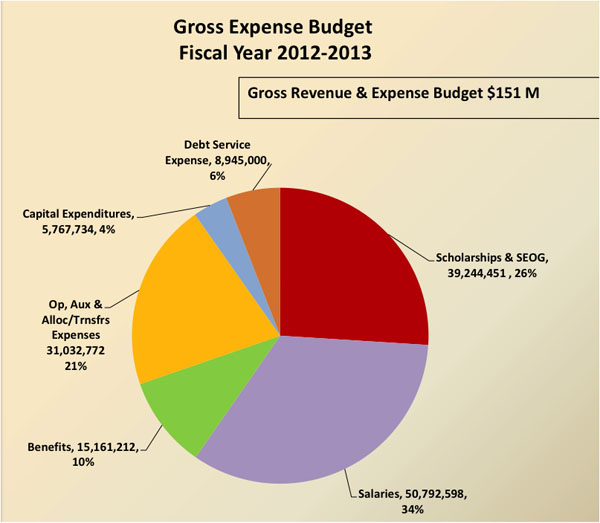

The college allotted more than a fourth of its gross revenue to scholarships and the Supplemental Educational Opportunity Grant (SEOG). This grant represents the money provided by the federal government to benefit lower-income undergraduate students.

“Dickinson awards funds to students on the basis of need, as well as merit,” said Richard Heckman, director of financial aid. “The average institutional scholarship/grant for all aided student[s] [this fiscal year] was $24,762. The average institutional scholarship/grant for aided students with need was $27,665.”

The gross revenue and expense budget of $151 million represents $106.1 million from tuition/fees, $3 million from contributions, $11.6million from investment income, $0.6 million from grants and $29.5 million from auxiliary and other revenue.

“Tuition does not cover all the expenses of providing the educational services of the college” said Margaret Stafford , associate director of planning and budget in financial operations. “Expenses cannot be covered without the money from the other revenue sources.”

Debt service is the principal and interest payments on the college’s long-term debt issued in the form of bonds, while capital expenditures are monies the college spends for items that become assets of the college.

“For example, a piece of scientific equipment is an example of a capital item,” said Stafford. “Other examples include library materials, furniture, computer infrastructure [and] building renovations.”

Operating, auxiliary and allocated/transfers expenses are operating expenses and all the general expenses incurred to run the college on a daily basis. These include supplies, services, taxes, utilities, repair and business travel. Auxiliary expenses are items that are purchased for resale, such as the items in the bookstore and Devil’s Den and the food purchased by Dining Services to make meals. The budgeted transfers consist mainly of monies allocated to replenish the college’s reserve from past draws, most notably the investment in the Banner system, the college’s main software package.

The salaries are for all the college’s employees, including student employees. The employee benefit expenses are the college’s portion of health insurance, matching Federal Insurance Contributions Act (FICA), Medicare, retirement contributions, workmen’s compensation, state unemployment compensation and tuition benefits.

The Office of Financial Operations expects that for next year’s pie chart, the total will increase for both revenue and expense, but the percentages will remain in about the same proportion to each other.

“Dickinson College relies on net tuition to provide 60 percent of its revenue. Obviously, excellent enrollment management has been and will continue to be crucial to the college’s success. Since all revenue streams are important, the college also is committed to prudent management of the endowment, sustained efforts to increase giving to the college and the efficient administration of the auxiliary operations,” said Stafford.