Talks of Divestment Reemerge Amongst Student Activism Groups

Discussions of the divestment of Dickinson College from fossil fuels have resurfaced following renewed interest from students. This includes a motion passed by Student Senate on Nov. 5, and the establishment of a student led organization called “Divest Dickinson.”

According to Vice President of Finance and Administration Bronté Burleigh-Jones, the college has no plans to divest itself due to how the fossil fuel investments are structured.

At the Nov. 5 Student Senate meeting, a resolution titled “A resolution of the Student Senate to endorse the divestment of fossil fuels and fracking by Dickinson College” was adopted by Senate. Premised on the grounds that, because the college currently has the articulated goal of carbon neutrality, and given the environmental harms posed by continued usage of fossil fuels, the motion called on the college to divest itself on grounds that “investment in fossil fuels and fracking goes against the message of Dickinson College and pushes an agenda against the wishes of the students.”

“It’s been an issue for a long time” said Provost Neil Weissman, “students have brought it up on occasion, and others have as well, including visitors.”

The primary impediment to divesting the college, according to Burleigh-Jones, is exactly how the portion of the college’s endowment is invested in fossil fuels. Rather than directly holding stocks or bonds in a particular company, the college outsources its investment decisions to an external company which “pools the college’s endowment with the endowments of 11 other nonprofit colleges and foundations,” she said. Burleigh-Jones explained that each college owns a portion of the overall fund, rather than owning a stake in any of the particular investments held by the fund. “Therefore, the college does not directly own fossil fuel investments but owns a share of funds which hold such investments.” Burleigh-Jones noted that exactly which stocks to purchase is a decision made by managers of the fund operated by the external company, rather than a decision made by any of the colleges individually. As of June 30, the college currently has invested $22.8 million with the external company which goes to fossil fuel companies, which constitutes 5.6 percent of the college’s total endowment value. Burleigh-Jones added this figure has been consistent since 2013, but “fossil fuel exposure exists in a variety of funds and investments so it is difficult to say how long we have owned a particular asset.”

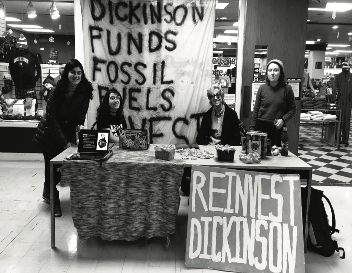

These investments have raised concerns from students, and prompted the creation of Divest Dickinson. Members of the organization include Katie Schorr ’21, Carson Butler ’22, Espoir DelMain ’21, Andrea Wrenn ’23, and Lauren Fordyce ’20. Schorr explained the origins of the organization began in “The fact that it’s the year of carbon neutrality, the fact that there has been in uptake a little bit in student activism on campus this semester” prompted thought about divestment. This led to a decision “to start a specific group with the goal of tackling divestment and encouraging that to happen on campus,” Schorr said.

Fordyce added that “is the time to do something” because “it’s becoming increasingly apparent the effects the fossil fuel industry has on people and the planet,” and that the organization is waiting to develop a “very strong student movement” before dealing directly with college administration.

Burleigh-Jones explained that, currently, “There are no current plans to divest from fossil fuels in our endowment” without leaving the investment group as a whole because of how the college’s funds are intermingled with those of other institutions, and that the college receives an average annual return on investment of 9.8 percent from the endowment investments.

“Dickinson’s endowment consists of approximately 900 donor accounts established for a variety of purposes,” Burleigh-Jones explained, “our primary fiduciary responsibility continues to be to maximize long-term returns within the college’s stated risk parameters, as identified by the board of trustees.” Burleigh-Jones explained that the topic of divestment was first broached in 2007, when “a student proposal to consider divestment from companies in Darfur, Sudan led to the creation of the Socially Responsible Investment Discussion Group, consisting of members from faculty, staff and the student body.” This group served to recommend “socially responsible” investments for the college. A Sustainable Investments Task Force was also created in 2013 following additional calls for divestment.

“Their reasoning comes off as dishonest” said Bulter.

“I think it’s hypocritical of the school to talk about how sustainable it is” added Schorr, “I think what they are doing is good but I don’t think it’s enough. I think they are finding short cuts and work around where they could just be doing the right thing and wholly being as sustainable as possible.” Schorr said that the college has not yet divested because “they are lazy. I think they are lazy. The Board of Trustees don’t want to do the work to divest us from fossil fuels because it’s easier for them to keep on accruing money in this way.” The solution to this is then to draw attention to the issue, and “make [the trustees] feel like there’s enough pressure on them, they will do it, they will divest. […] We know it’s possible and doable.”

Espoir DelMain • Dec 5, 2019 at 10:20 pm

Check out this article.

A Reversal on Fossil Fuels

Nearly six years after Middlebury rejected a push to divest, the college announces that it will slowly draw down fossil fuel holdings in its $1 billion endowment. What changed?

https://www.insidehighered.com/news/2019/02/11/middlebury-fossil-fuel-divestment-took-generations-students-pull